European stocks are expected to open higher Tuesday as investors take heart from U.S. President Barack Obama's extension of the Bush-era tax credits and the potential for further quantitative easing in the world's largest economy. However, gains are likely to be limited by ongoing European sovereign-debt concerns and fears of further policy tightening in China.

"The euro-zone debt issue continues to linger. Although there's a lid on this for the time being, the debate continues as to how best to manage the future and the fractures in the monetary union that are appearing," said Chris Weston at IG Markets.

Weston called London's FTSE 100 index to open 16 points higher at 5786, Germany's DAX index up 18 points at 6972 and Paris's CAC-40 index eight points higher at 3757.

The issue of euro-zone sovereign debt will continue to be at the forefront of investors' minds as Ireland prepares to vote on its austerity budget Tuesday. "The vote for the budget is crucial since it is a prerequisite to the activation of the EU/IMF assistance mechanism," said ING. "While today's vote might appease markets somewhat, the jury is still out on whether Ireland will be able to consolidate its public finances without having to undergo a debt restructuring in the coming years," it added.

Investors will also keep an eye on Brussels as the second day of meetings of European finance ministers gets under way. Following weeks of turmoil in the European debt markets and amid calls to increase the size of the bailout fund, euro-zone ministers said Monday that the European Financial Stability Facility does not need more money to cope with the current sovereign-debt crisis.

Meanwhile, investors in Europe will get their first chance to react to a report in the state-run China Securities Journal, saying that the People's Bank of China may hike interest rates this weekend, before the release of inflation data for November on Monday. The front-page report, which cited analysts, also said the upcoming Central Economic Work Conference increases the chance of a rate hike soon.

On the economic calendar, U.K. industrial output and German factory orders data are due at 0930 GMT and 1100 GMT, respectively. Credit Agricole Corporate and Investment Bank said both sets of data are likely to be positive and show bigger-than-expected rises.

On Wall Street Monday, stocks paused following last week's run up and after Federal Reserve Chairman Ben Bernanke's tepid assessment of the U.S. economic recovery. The Dow Jones Industrial Average fell 0.2% to 11,362.19, the Nasdaq Composite edged up 0.1% to 2594.92 and the Standard & Poor's 500-stock index edged down 0.1% at 1223.12.

"Given the strength in the market last week, there's nothing wrong with sideways right now," said Jim Meyer, chief investment officer at Tower Bridge Advisors. "Over the past month or so, there's been a clear inflection point in terms of economic growth, excluding Friday's unemployment report which, like everybody else, leaves me scratching my head."

Some investors were sobered by the tone of the Fed chairman's economic outlook in a Sunday interview on CBS News's "60 Minutes."

Bernanke warned the economic recovery "may not be" self-sustaining. Still, he said he doesn't think a double-dip recession in the U.S. is likely. The central banker also said the Fed could commit more money to boost the economy after last month announcing $600 billion of asset purchases.

In Asia, stock markets were mixed Tuesday as the mild Wall Street losses on Monday crimped demand, while the Shanghai market was down on the media report that the Chinese central bank may hike rates around the weekend.

Japan's Nikkei Stock Average was off 0.3%, Australia's S&P/ASX 200 was up 1.0%, South Korea's Kospi Composite rose 0.3%, China's Shanghai Composite Index fell 0.3%, Hong Kong's Hang Seng Index was up 0.5% and India's Sensex was down 0.5%.

While the Chinese report may not reflect official views in Beijing, traders noted that China has a history of announcing tightening measures outside market hours. China announced an interest rate hike, the first in nearly two years, on the evening of Oct. 19, two days before the release of the inflation data for September.

The Australian market extended morning gains with the benchmark S&P/ASX 200 index rising to a three-week high of 4727.2 after the country's central bank held rates steady at 4.75% and adopted a benign stance on policy.

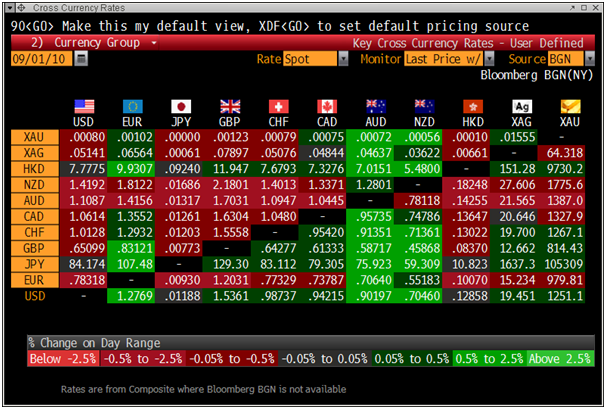

In the European foreign exchanges, the euro gained slightly against most other currencies Tuesday as investors remained focus on the meetings of European ministers in Brussels. By 0720 GMT, the euro was trading at $1.3334, up from $1.3308 late Monday in New York, and at Y110.16, up from Y110.04. The dollar was trading at Y82.59, down from Y82.66.

Among commodities, spot gold was at $1422.05 per troy ounce, down $1.55 from New York, after setting a new high Monday at $1427.20. January Nymex crude oil futures were down nine cents at $89.29 per barrel.

In the bond markets the December bund futures contract was down 0.07 at 126.50.

Read More

http://online.wsj.com/article/BT-CO-20101207-701541.html

"The euro-zone debt issue continues to linger. Although there's a lid on this for the time being, the debate continues as to how best to manage the future and the fractures in the monetary union that are appearing," said Chris Weston at IG Markets.

Weston called London's FTSE 100 index to open 16 points higher at 5786, Germany's DAX index up 18 points at 6972 and Paris's CAC-40 index eight points higher at 3757.

The issue of euro-zone sovereign debt will continue to be at the forefront of investors' minds as Ireland prepares to vote on its austerity budget Tuesday. "The vote for the budget is crucial since it is a prerequisite to the activation of the EU/IMF assistance mechanism," said ING. "While today's vote might appease markets somewhat, the jury is still out on whether Ireland will be able to consolidate its public finances without having to undergo a debt restructuring in the coming years," it added.

Investors will also keep an eye on Brussels as the second day of meetings of European finance ministers gets under way. Following weeks of turmoil in the European debt markets and amid calls to increase the size of the bailout fund, euro-zone ministers said Monday that the European Financial Stability Facility does not need more money to cope with the current sovereign-debt crisis.

Meanwhile, investors in Europe will get their first chance to react to a report in the state-run China Securities Journal, saying that the People's Bank of China may hike interest rates this weekend, before the release of inflation data for November on Monday. The front-page report, which cited analysts, also said the upcoming Central Economic Work Conference increases the chance of a rate hike soon.

On the economic calendar, U.K. industrial output and German factory orders data are due at 0930 GMT and 1100 GMT, respectively. Credit Agricole Corporate and Investment Bank said both sets of data are likely to be positive and show bigger-than-expected rises.

On Wall Street Monday, stocks paused following last week's run up and after Federal Reserve Chairman Ben Bernanke's tepid assessment of the U.S. economic recovery. The Dow Jones Industrial Average fell 0.2% to 11,362.19, the Nasdaq Composite edged up 0.1% to 2594.92 and the Standard & Poor's 500-stock index edged down 0.1% at 1223.12.

"Given the strength in the market last week, there's nothing wrong with sideways right now," said Jim Meyer, chief investment officer at Tower Bridge Advisors. "Over the past month or so, there's been a clear inflection point in terms of economic growth, excluding Friday's unemployment report which, like everybody else, leaves me scratching my head."

Some investors were sobered by the tone of the Fed chairman's economic outlook in a Sunday interview on CBS News's "60 Minutes."

Bernanke warned the economic recovery "may not be" self-sustaining. Still, he said he doesn't think a double-dip recession in the U.S. is likely. The central banker also said the Fed could commit more money to boost the economy after last month announcing $600 billion of asset purchases.

In Asia, stock markets were mixed Tuesday as the mild Wall Street losses on Monday crimped demand, while the Shanghai market was down on the media report that the Chinese central bank may hike rates around the weekend.

Japan's Nikkei Stock Average was off 0.3%, Australia's S&P/ASX 200 was up 1.0%, South Korea's Kospi Composite rose 0.3%, China's Shanghai Composite Index fell 0.3%, Hong Kong's Hang Seng Index was up 0.5% and India's Sensex was down 0.5%.

While the Chinese report may not reflect official views in Beijing, traders noted that China has a history of announcing tightening measures outside market hours. China announced an interest rate hike, the first in nearly two years, on the evening of Oct. 19, two days before the release of the inflation data for September.

The Australian market extended morning gains with the benchmark S&P/ASX 200 index rising to a three-week high of 4727.2 after the country's central bank held rates steady at 4.75% and adopted a benign stance on policy.

In the European foreign exchanges, the euro gained slightly against most other currencies Tuesday as investors remained focus on the meetings of European ministers in Brussels. By 0720 GMT, the euro was trading at $1.3334, up from $1.3308 late Monday in New York, and at Y110.16, up from Y110.04. The dollar was trading at Y82.59, down from Y82.66.

Among commodities, spot gold was at $1422.05 per troy ounce, down $1.55 from New York, after setting a new high Monday at $1427.20. January Nymex crude oil futures were down nine cents at $89.29 per barrel.

In the bond markets the December bund futures contract was down 0.07 at 126.50.

Read More

http://online.wsj.com/article/BT-CO-20101207-701541.html

No comments:

Post a Comment