Lots of normal people would pay $23 for a book.

But $23.7 million (plus $3.99 shipping) for a scientific book about flies!?

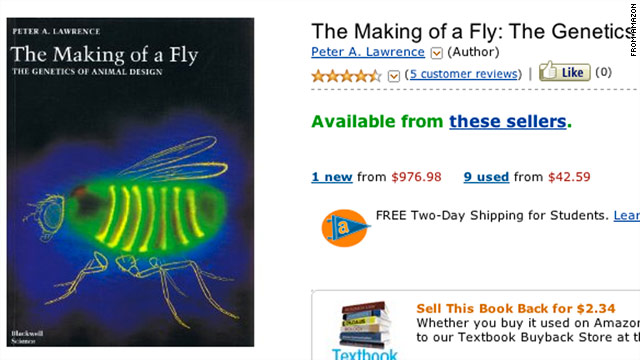

This unthinkable sticker price for "The Making of a Fly" on Amazon.com was spotted on April 18 by Michael Eisen, an evolutionary biologist and blogger.

The market-blind book listing was not the result of uncontrollable demand for Peter Lawrence's "classic work in developmental biology," Eisen writes.

Instead, it appears it was sparked by a robot price war.

"What's fascinating about all this is both the seemingly endless possibilities for both chaos and mischief," writes Eisen, who works at the University of California at Berkeley and blogs at a site called "it is NOT junk." "It seems impossible that we stumbled onto the only example of this kind of upward pricing spiral."

Eisen watched the robot price war from April 8 to 18 and calculated that two booksellers were automatically adjusting their prices against each other.

One equation kept setting the price of the first book at 1.27059 times the price of the second book, according to Eisen's analysis, which is posted in detail on his blog.

The other equation automatically set its price at 0.9983 times the price of the other book. So the prices of the two books escalated in tandem into the millions, with the second book always selling for slightly less than the first. (Not that that matters much when you're selling a book about flies for millions of dollars).

The incident highlights a little-known fact about e-commerce sites such as Amazon: Often, people don't create and update prices; computer algorithms do.

Individual booksellers on Amazon and other sites pay third-party companies for algorithm services that automatically update prices. Some of these computer programs purportedly work very well, getting sellers up to 60% more sales because they underbid the competition automatically and repeatedly.

The advantages are clear: If you're managing dozens of sale items on Amazon or eBay, it's difficult if not impossible to keep up with all of them.

"If you have more than 100 items, then it's impossible for you to manually focus on the price," said Victor Rosenman, CEO of a company called Feedvisor, which sells algorithm services to people who use Amazon.

"It's pretty much like the stock exchange. What you see there is the prices changing all the time -- but they never change drastically. Sometimes it's a dollar here a dollar there -- maybe $10. For a book, it probably would be pennies."

These algorithms vary widely in quality, however, as the Amazon case shows.

Sellers easily can avoid the million-dollar-book situation if they set price ceilings and floors on their pricing algorithms, so that the competitive bidding shuts off at a certain dollar mark, Rosenman said.

"It's like you put on the gas and didn't have the handbrake," he said. "This is a very basic mistake. So I am very, very surprised this thing happened at all."

Some of these algorithm services give clients control over their equations, letting them edit them as they go. That doesn't always work out well, Rosenman said.

Read More

http://www.cnn.com/2011/TECH/web/04/25/amazon.price.algorithm/

No comments:

Post a Comment